This week's reads (they are kind of random):

Cramer: Don’t break these rules if you want your stock portfolio to make money

- Panic is not a strategy

- There is always a better time to sell than into the maelstrom

- Stay away from after-hours trading

- Check your emotions at the door

- Don’t sell all at once

Investors can hide out in domestic stocks from the China trade war

“What we are focusing on with our clients now... are companies that are more domestically facing in terms of the source of their revenue,” Goldman Sachs chief U.S. equity strategist David Kostin,

There's another article that advised investing in companies that generate revenue from services rather, which suffer less impact from the tariffs raise.

Definitive Guide to Dividend Withholding Tax in Stock & Passive Investing (by Investment Moat)

He did a wonderful write-up demystifying withholding tax and these are the areas covered:

- Tax When Money Flows out of the Country

- The Withholding Tax around the World (Data Tables)

- It is not Where it is Listed but Where the Company is Domiciled

- How do we tell where a Stock or Fund is Domiciled or Incorporated?

- What about Dual Taxation Treaties?

- Unpacking the Withholding Tax on Exchange Traded Funds and Unit Trust

Are fully franked ASX dividends better than unfranked dividends?

Applicable for only Australian stocks.

How Thailand Created A Multi-Billion-Dollar Blue Ocean in Medical Tourism and How It Just Might Create Another

---

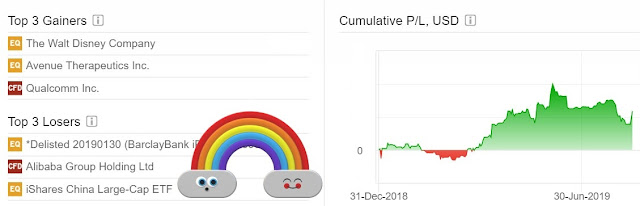

The stock market is still riding up and down based on Trump's tweets and sentiments on the trade war progression. I hope my trading portfolio can stay afloat for 4 more months till year end to mark this trading year as a positive one.

I gotta kick myself for making rash trade moves at the start of this month. Need to be more MINDful!

Click here for resources on Trading Strategies.

Just for thought -

Can trading be a subset of investing?

Are they really mutually exclusive?

|

| My YTD results |

***

Check out my Blog Archives here for previous posts

Are you putting on trader or investor hat?

ReplyDeleteHi Uncle8888,

ReplyDeleteTrader's hat for the US Market. Gainers and Losers are all short-term positions and I am holding none of them now.

Trading feels like taming a wild beast - let it go, pull it back, and hope I don't fall off till my destination is reached.

DeleteInvesting feels like keeping a pet hen. Pray it stays healthy, doesn't run around too much and just keeps laying eggs.