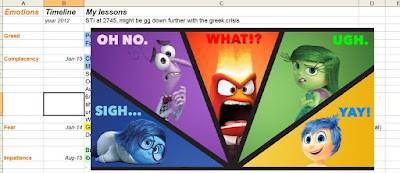

My investment "Inside-Out"

We are often overwhelmed by many emotions when navigating through our investment decisions. Thus, I have made it a habit to document and reflect upon those emotions together with investment mistakes that I've made. I know otherwise I would have the tendency to keep repeating my old mistakes. So I have created an Inside-Out table in an excel sheet format. (Yes, the boring excel sheet is a wonderful tool for all sorts of recording!) The table has got three columns which runs down chronologically. One column is the date, one is the emotions or 'how I was feeling at that point' and the third is a description of the mistakes made. 'How I am feeling' column is filled according to my emotion that triggered the mistake at that point when I made the decision. I find this chart very useful in helping me to identify and keep track of which emotions hindered my investment decisions. This is an example of my "Inside-Out" table: