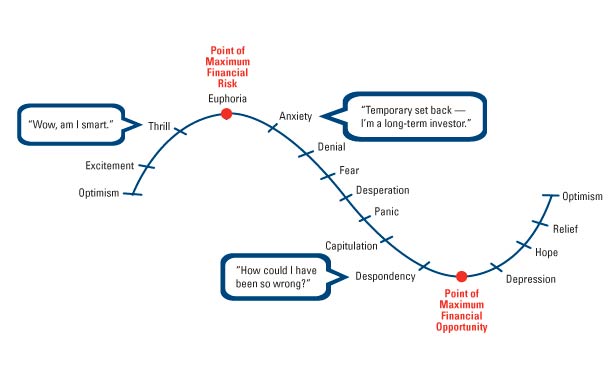

Time flies and it's already a year since I have embarked on trading the US market . It's a small portion of my portfolio as I still deemed it as experimental. My result sheet, as mentioned before, is far from fantastic despite my better trade executions this year. This is because I have downsized my positions and used less CFD (margin) to trade, as a result, my gains are smaller compared to old losses on CFD last year. Looking back, I would attribute 50% of my gains this year to luck and 50% to discipline. Discipline to wait for the right signal before entering, discipline to set a stop loss and stick to it, discipline to keep the winner and not take profit too early. I would recommend this fantastic read about trading, with useful infographics - Here is a secret why the more you want to earn Million Dollars from trading, the tougher it become (external link)