No matter how I look at it, the trade war still didn't dent the market enough. We are currently still riding the secular bull market from 2011/2012.

Those who have accumulated by DCA would be very happy. Especially on the US index.

Those who have been preparing for a bear market to kick in since a few years ago, have they given up or let their guards down already?

STI's volatility was largely attributed to the swings in financial sector's stock prices as they constituted a whooping 38.4% in the STI based on caps, although telcos also played a part. The telcos are now left with only Singtel after Starhub dropped out of the list, contributing 8.3% and the Jardine group of stocks contributing roughly 11%. (Data up to date)

S&P 500, on the other hand, are heavily weighted on tech stocks. The tech stocks made up more than a quarter of the S&P 500 at 25.78%. Financial is the second-largest at 14.65%, followed by Health Care at 13.71%, and then Consumer Discretionary at 12.86%. (Source: https://seekingalpha.com/article/4172093-s-and-p-500-sector-weightings-tech-nears-26-percent)

The run up of US tech stocks' equity has started since 2010 with a spike in the recent few years. What it would take for a bear to swipe the table would most probably be a slump in the technology sector. However, as long as the demand stays strong and growth in earnings stays consistent, I think it (S&P 500) would remain unfazed - trade war or not. During the dot-com bubble, tech stocks ran up much higher and more steeply. With AI (I was fascinated to read about xiaomingbot), drones, driverless cars, faster chipsets and more coming up, it would be interesting to see how the tech giants play their cards.

***

Check out my Blog Archives here for previous posts

Those who have accumulated by DCA would be very happy. Especially on the US index.

Those who have been preparing for a bear market to kick in since a few years ago, have they given up or let their guards down already?

|

| STI - source: Yahoo Finance chart |

|

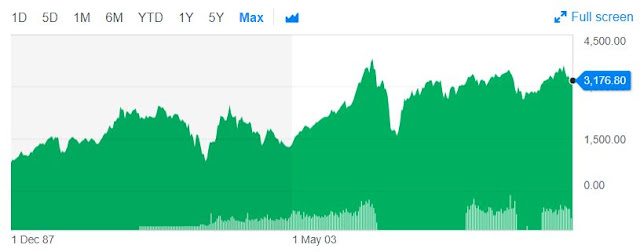

| VOO - source: Yahoo Finance chart |

STI's volatility was largely attributed to the swings in financial sector's stock prices as they constituted a whooping 38.4% in the STI based on caps, although telcos also played a part. The telcos are now left with only Singtel after Starhub dropped out of the list, contributing 8.3% and the Jardine group of stocks contributing roughly 11%. (Data up to date)

S&P 500, on the other hand, are heavily weighted on tech stocks. The tech stocks made up more than a quarter of the S&P 500 at 25.78%. Financial is the second-largest at 14.65%, followed by Health Care at 13.71%, and then Consumer Discretionary at 12.86%. (Source: https://seekingalpha.com/article/4172093-s-and-p-500-sector-weightings-tech-nears-26-percent)

The run up of US tech stocks' equity has started since 2010 with a spike in the recent few years. What it would take for a bear to swipe the table would most probably be a slump in the technology sector. However, as long as the demand stays strong and growth in earnings stays consistent, I think it (S&P 500) would remain unfazed - trade war or not. During the dot-com bubble, tech stocks ran up much higher and more steeply. With AI (I was fascinated to read about xiaomingbot), drones, driverless cars, faster chipsets and more coming up, it would be interesting to see how the tech giants play their cards.

"When you realized you cannot beat the market...

You either go with the flow OR

Stay OUT of it."

It is worth taking a step back to look at the macro-economics and what moves it. Identify the sectors that are growing, the ones that are upcoming and the ones that are fading...

After the bitcoin 'bubble', we have the up and coming 'pot stocks'. For those not happy to stay in the boring currant, you can dabble in that for a roller coaster wild ride e.g. Tilray. As we can see, it didn't take long before long holders raked in and short-sellers gave up. (Warning: This roller coaster doesn't provide seat belt one hor. That is what I call pure speculative play, nothing to do with value or earnings whatsoever.)

Check out my Blog Archives here for previous posts

Comments

Post a Comment