Trade opened on 23rd Feb, trade closed on 25th Feb.

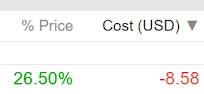

And I thought only crypto can pull off this feat (+26.5%). This is a stock. No no, it's not GameStop, although it's on fire too.

Looks like the US market is really supercharged. Or it's just pure dumb luck here?

For SG stocks, we have to wait neck long long even for a 10% price gain!

Just one important thing to bear in mind - crazy spikes may precede equally crazy plunges. We have to beware and stick well to risk management.

--

Quick update

I have opened an Endowus account. Previously, I wasn't keen on any robo advisor. So what made me changed my mind?

Firstly, I want to put excess cash (rotting in bank account) into a vastly diversified portfolio with exposure to global funds, especially that of the emerging markets. Secondly, it is more time and effort efficient than DIY picking of individual stocks across different markets and pull hair over currencies conversion when purchasing them (aka when rising tide raise all boats, what's the point of doing individual stock picking?). Thirdly, it can auto-rebalance the portfolio for me.

The account opening process is quite fuss-free using SingPass. Investment can be made from cash, SRS or CPF (I shall not elaborate as you can read up the details on Endowus website or at Seedly, Financial Horse etc). What I like about this robo advisor is that we can customize our own fund mix and each fund's % allocation. We can also set up recurring investment to the "goals" (portfolio). Also, it charges a flat accessing fee of 0.4% with no trailing fees. In terms of fund / fund houses, there are a great many on the platform for you to choose from. Just have to be mindful of the management fee of each fund as they vary significantly.

So far the only downside that I have encountered is the bank fund transfer process seemed slow (>1 working day). (The cash amount for investment would first need to be transferred to your UOB Kay Hian trust account before appearing on the platform for you to invest.) However, it should not pose a big problem since it is not a trading portal where time is of essence.

If you are interested to open an account, feel free to PM me.

Like what you read? Follow me on Facebook or Twitter for updates and news that I dig.

Check out my referral links for fantastic sign up bonuses on SAXO, Moomoo, Gemini, Celsius, Blockfi and more platforms.

🤗

Thanks for reading!

Disclaimer: Contents of this blog are personal opinions and NOT financial advice to buy or sell any mentioned securities, commodities or assets.