Current STI level:

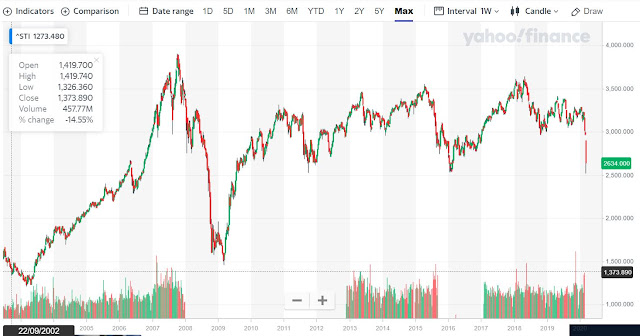

We are not even at half-way point in drop compared to the GFC period in 2008 (look to the left big plunge).

Chill.

When we thought price can't get any higher (in bull), they do. When we thought prices can't get any lower (in bear), they do too.

How far will it drop this time depends on how fast the covid-19 pandemic gets controlled and what kind of fiscal policies get rolled out. No one can predict. So it's important to be patient and time our entries well. Don't be caught in dead cat bounce.

Below was my blog post from 2 years ago.

In 2018, when market keeps chionging despite volatility, we are almost in a disillusion that spring will last forever...

----

Posted 12/03/18

With reference to an old post: A new worse - STI Aug 2011, two more lessons added on:

Lesson Five - Be nimble. Be impatient to the weeds. Slowly rake in the gems when they are on sale and be very patient with the gems.

Lesson Six - if chance permits, short those stocks that fuel the Bear. (Be careful not to short too late. As we can see over the years, major down trends lasted shorter than major up trends.)

Market downturn will always repeat itself again. Triggers may be different but learning points are the same!

How ready are we to face a 'new worse'?

We are not even at half-way point in drop compared to the GFC period in 2008 (look to the left big plunge).

Chill.

When we thought price can't get any higher (in bull), they do. When we thought prices can't get any lower (in bear), they do too.

How far will it drop this time depends on how fast the covid-19 pandemic gets controlled and what kind of fiscal policies get rolled out. No one can predict. So it's important to be patient and time our entries well. Don't be caught in dead cat bounce.

|

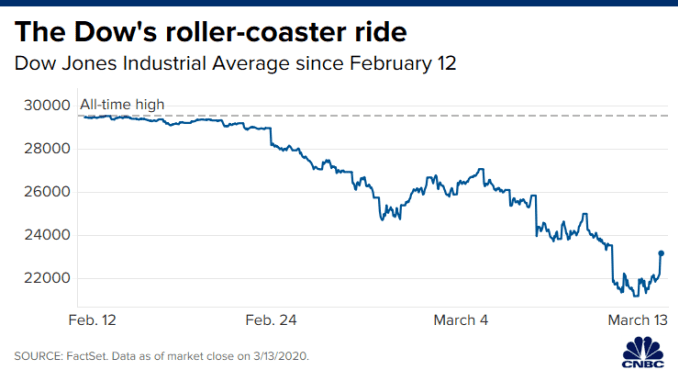

| Source: CNBC |

Below was my blog post from 2 years ago.

In 2018, when market keeps chionging despite volatility, we are almost in a disillusion that spring will last forever...

----

Posted 12/03/18

With reference to an old post: A new worse - STI Aug 2011, two more lessons added on:

Lesson Five - Be nimble. Be impatient to the weeds. Slowly rake in the gems when they are on sale and be very patient with the gems.

Lesson Six - if chance permits, short those stocks that fuel the Bear. (Be careful not to short too late. As we can see over the years, major down trends lasted shorter than major up trends.)

"Stock market takes the escalator down but stairs up." (I read this from Uncle8888's blog.)

|

| STI 10 years - plunge points |

Market downturn will always repeat itself again. Triggers may be different but learning points are the same!

How ready are we to face a 'new worse'?

***

Like what you read? View my other posts here

Comments

Post a Comment