The crazy spike & why I finally opened Endowus account

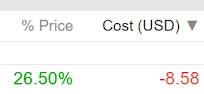

Trade opened on 23rd Feb, trade closed on 25th Feb. And I thought only crypto can pull off this feat (+26.5%). This is a stock. No no, it's not GameStop, although it's on fire too. Looks like the US market is really supercharged. Or it's just pure dumb luck here? For SG stocks, we have to wait neck long long even for a 10% price gain! Just one important thing to bear in mind - crazy spikes may precede equally crazy plunges . We have to beware and stick well to risk management. -- Quick update I have opened an Endowus account. Previously, I wasn't keen on any robo advisor. So what made me changed my mind? Firstly, I want to put excess cash (rotting in bank account) into a vastly diversified portfolio with exposure to global funds, especially that of the emerging markets. Secondly, it is more time and effort efficient than DIY picking of individual stocks across different markets and pull hair over currencies conversion when purchasing them (aka when rising tide raise ...