My DeFi adventure

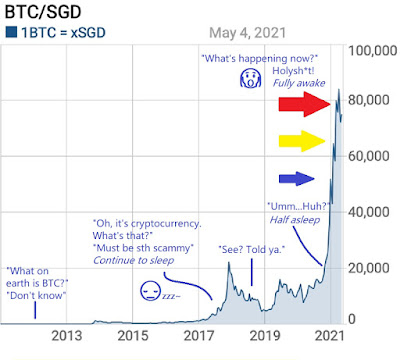

How dumb a timing can that be right? Especially when I just blogged about crypto cycle and DCA . Nevertheless, I think it's a good learning experience and I didn't regret for not sitting on my hands. Let me share some quick takeaways that I have from dabbling in this very intriguing space. (Due to the high gas cost when I started, I migrated most of my funds to Polygon which is a Layer 2 solution to bypass the high gas cost on the Ethereum mainnet.) SushiSwap liquidity mining