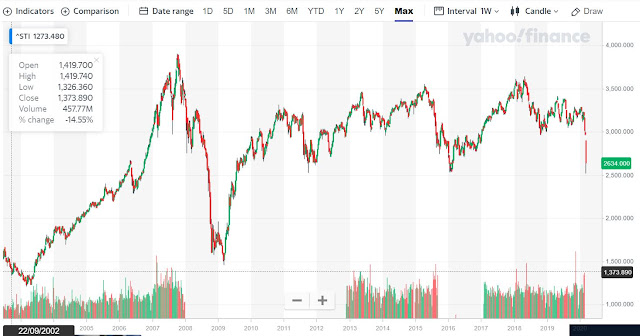

Dead cat bounce?

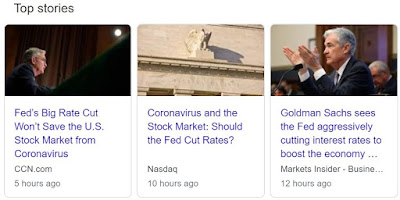

Like a twisted Pascal's wager, I would rather believe in a dead cat bounce than not - and therefore I am not buying the bounce. If it is indeed a dead cat bounce, it would means more room to fall in the coming months. If it is not a dead cat bounce, then I can congratulate myself for holding on tight to my stocks that have seen more than 20% plunges in the past couple of weeks. WILL IT BE LIKE THIS? OR THIS? Source: Investopedia --- Sequel to my previous post ... When we see dark clouds in the distance and don't act, we are plain dumb. When we are drenched, we wondered why we didn't act earlier. No one to blame. So what to do? Believe. Believe that the dark cloud will past eventually. For the younger generations, there's time on your side. It's the perfect opportunity now for you to observe and learn from any mistake. Perhaps 10 years down the road, we will look back at what we have been through and laugh at ourselves (for o