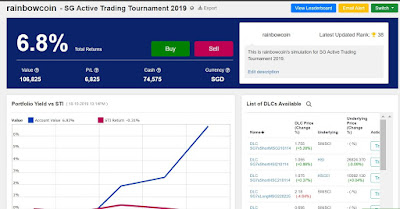

It is my first time participating in a trading tournament, just for fun. Contest's elimination round is open till 8th November. https://www.investingnote.com/simulation_campaigns/sg-active-trading-tournament-2019

Total 1837 participants at the time of writing. My rank 38.

The underlying derivative for trading is called 'DLC' which stands for Daily Leverage Certificates. You can read more about it here.

"The issue price of a DLC is arbitrary, i.e. it is decided by the issuer, which is similar to the mechanism of a stock or an ETF. For DLC, issuers determine the issue price that strikes a balance between tighter spread and higher sensitivity.

Because DLC issue price is arbitrary, for two DLCs of the same underlying asset, direction and leverage but of different prices, the lower-priced DLC should not be considered as more cost-effective than the higher-priced one. In fact, the higher-priced DLC will be more sensitive than the lower-priced DLC and hence will be a better product from short-term trading perspective."

The catch for this tournament is that only Market Orders can be placed, no advanced order is allowed and no stop loss order. As it is a market order, the trader will always get the shorter end of the stick when a position is initiated. I will just take it as a board game experience cos I am not so free to be monitoring the market all day! Lol

Ask me if I would trade DLC in real life, probably not. Day trading is not my thing and I do not fancy the use of leveraged products much. It would be good simulation exercise for newbies, if they trade actively throughout this tournament, to have a feel of how's their trading psychology and whether sheer luck has been mistaken for skill.

What a successful trader and a successful business man have in common is that they are both as perspicacious. They swoop like an eagle and not hop about like a rabbit.

By the way, I will be overseas these few days and most likely you will see my ranking plunge drastically after I come back next week. Till then!

-----------------------------

Update 09/11/2019

True enough my ranking has plunged to a whopping #743 upon tournament closure (my best was #20).

My biggest losing position being DLC SG5xShort Sands which I bought size-ably before going on holiday and just left it there without cutting loses.

With DLC both loses and wins are magnified. Trade analysis and execution with discipline are very important in order not to lose big time. I admit that towards the end, I didn't bother to put in effort anymore for the virtual game.

Well, next year shall try again.

***Update 09/11/2019

True enough my ranking has plunged to a whopping #743 upon tournament closure (my best was #20).

My biggest losing position being DLC SG5xShort Sands which I bought size-ably before going on holiday and just left it there without cutting loses.

With DLC both loses and wins are magnified. Trade analysis and execution with discipline are very important in order not to lose big time. I admit that towards the end, I didn't bother to put in effort anymore for the virtual game.

Well, next year shall try again.

Like what you read? View my other posts here

Comments

Post a Comment