I know it's a little early for weekend but since the post is ready I shall just share it. August was a turbulent trading month for me which started off with a big plunge to account value and it finally ended with a grand $0 gain / loss for all my time and effort. The plunge was because of entering a trade too early and I hedged my position too late. Given the volatile market these days, I set a 'take profit' this round and locked in some profit before the market closed over last weekend. (Now with my feet in the US market, I have to take note of its public holidays too, eg. first Monday of every Sep is labor day.)

Trading outcome is heavily influenced by our money and mind management - stay calm and execute with discipline. Method is just a theory without the two.

Just an idea - perhaps we can think of the current volatility as mini episodes of market cycle.

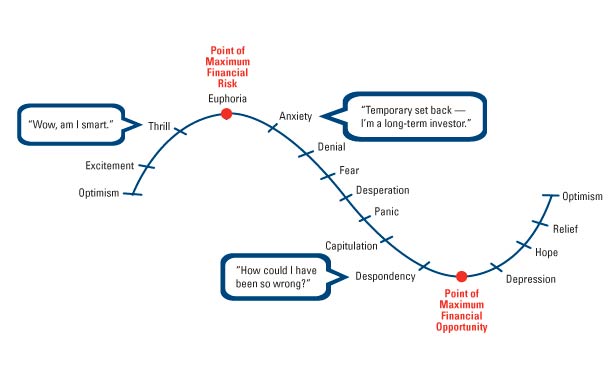

Investors / traders are reacting like what's in the image below whenever there's a good tweet or a bad news, resulting in wild price swings (and gapping phenomenon). We see that happening almost every week these days.

Trading outcome is heavily influenced by our money and mind management - stay calm and execute with discipline. Method is just a theory without the two.

Just an idea - perhaps we can think of the current volatility as mini episodes of market cycle.

Investors / traders are reacting like what's in the image below whenever there's a good tweet or a bad news, resulting in wild price swings (and gapping phenomenon). We see that happening almost every week these days.

|

| Source: Market express |

We know that the market is dynamic and seldom goes in the way that we predicted, but we know eventually it will revert to mean. When we think of it as such, it may become easier for us to navigate the 'turmoil'.

Buy low, sell high. Short high, cover low.

Rinse and repeat.

Ride the cycles.

----------

Here are some reads to boost our brain juice.

Understanding 7 Common Stock Market Risks As Retail Investors

Big thanks to Uncle8888 for consolidating these stock market risks from his past multiple posts into a single post.

Here’s whether it makes sense to ditch stocks and move to cash

"At the same time, though, you would have missed five dividend payments and, once reinvested, their future gains, as well. More importantly, recognizing both the top and bottom is tricky.For example, when the market began to slowly climb back upward in early 2009, the U.S was still in a recession, which didn’t end until that summer. Unemployment was still climbing — it didn’t peak until October 2009 when it hit 10% — and the foreclosure crisis was continuing to worsen."

Same Salad, Different Day

"Here are the five main benefits from taking this approach:

- Not having to think about what to eat (decision fatigue)

- Eating a healthy diet without reading labels or counting calories (nutrition)

- Saving time and mental effort on shopping and food prep (batching)

- Maximising enjoyment through minimal effort (pleasure)

- Guilt-free enjoyment of the remaining ~20 per cent (novelty)"

This one simple trick makes everything faster and easier

"But if the shortcuts worked as promised, they wouldn’t be shortcuts, would they? They’d be the standard."

Overcoming Fears And Moving Ahead in Life

What's said is really true. Once I told myself I can handle it and I did, I kind of overcame my fear for flying cockroaches.-----

Many headlines are pointing to an economy slow down. The current economy and market bullishness are sustained by stimulus policies and optimism. It is uncertain how sustainable that will be, and for how long - I shall leave that guesswork to media and analyst. What I planned to do now is stay invested for dividends, and maintain my holding amount as of current. At the same time, I am searching for ways to hedge my invested capital should there be a recession.

Gold? Bonds? Short CFDs? (Maybe short CFD is a bad idea which I kind of failed to acknowledge. My short CFDs have been costing me a chunk. Bonds may be somewhat correlated to market, must be careful in picking too.)

This morning I read a Bloomberg article talking about how passive index funds are deemed to be another bubble. Hmm idea for thoughts.

***

Check out my Blog Archives here for previous posts

Comments

Post a Comment