Nowadays I tend to do most of my shopping online, so I am looking for a credit card that can offer maximum rebate based on my spending pattern. My most actively used one was the Standard Chartered Unlimited Cashback card, which gives a flat 1.5% cashback on all spending. No minimum spend, no cashback cap. I just pretty much tagged every spending to it, as long as credit card is accepted for payment. That's until my Crypto.com Ruby card came along with a 2% rebate in CRO. However, my CRO card cannot be used to top up wallets of platforms like Grabpay, Shopee. It worked well for normal online transactions in SGD as well as Paywave transactions at stores.

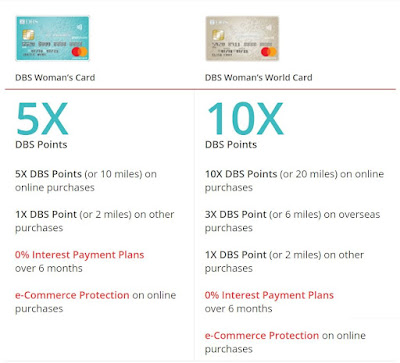

One caveat to earning credit cards' reward for me is that I don't spend a lot per month, so hitting auspicious figures like $888 or $600 to be eligible for some higher tier rebate is mission impossible. That brought me to look at DBS Woman's Card which awards points for spending and they can be redeemed in minimum of 100 points block per transaction above $1. The points will expire one year from the quarter earned. No minimum monthly spend needed to hit certain rebate tiers. You can refer here for the whole catalogue of rewards.

To see if the credit card is worth applying for, let's calculate if it would reward me more $ than my Standard Chartered card (eg. how much the points would work out in terms of percentage rebate per dollar spent).

I shall use two of the more easy-to-use redemptions to illustrate (with reward points from the highest reward tier which is Online spending):

1) 690 DBS points = $10 Fairprice voucher

1 point is worth reward of $10/690 = $0.0144

Regular card:

When every $5 spent earns 5 points ($0.072), (0.072*100)/5= 1.44 %

I will get 1.44% rebate for every dollar spent.

World card:

When every $5 spent earns 10 points ($0.144), (0.144*100)/5 = 2.88%

I will get 2.88% rebate for every dollar spent.

2) 1000 DBS points = $10 Paylah bill offset

1 point is worth reward of $10/1000 = $0.01

Regular card:

When every $5 spent earns 5 points ($0.05), (0.05*100)/5= 1%

I will get 1% rebate for every dollar spent.

World card:

When every $5 spent earns 10 points ($0.1), (0.1*100)/5 = 2%

I will get 2% rebate for every dollar spent.

In conclusion, it makes sense for me to apply for the DBS Woman's World Card but not the regular Woman's Card. Do bear in mind that reward points earned would be lower than estimated due to rounding down effect eg. $24 spent, you only get points based on $20. The main caveat is that in order to earn 10x points, it has to be online spending. So for my dining and other retail spending, I will be sticking with my Standard Chartered card.

There is currently a promo code <DECFLASH> that is valid till 11 January 2022 for new applicant who are not the principle card holder of any DBS/ POSB credit card.

As I don't think I will be travelling anytime soon, I am not looking into miles accumulation at this point. I may update this post with miles calculation on another day when I am not so sleepy. Ciao~

Are you looking for a trading platform to kickstart your investment? Sign up with my referral to Futu Moomoo for FREE Apple share and more!

I have been using Moomoo to trade for many months and here's what I like about it.

- Low commission fees

- No custodian fee

- Wide array of instrument to trade eg. stocks, ETF, forex, options, cfd

- Brilliant data analytics and trading features (on both desktop and mobile app)

- Fast money transfer and good exchange rate for SGD/USD

(Please read the full terms and conditions on how to claim the rewards on Moomoo's website!)

Like what you read? Follow me on Facebook or Twitter for updates and news I dig.

Check out my referrals for fantastic sign up bonuses on SAXO, Moomoo, Gemini, Celsius, Blockfi and more.

🤗

Thanks for reading!

Comments

Post a Comment