We are often overwhelmed by many emotions when navigating through our investment decisions. Thus, I have made it a habit to document and reflect upon those emotions together with investment mistakes that I've made. I know otherwise I would have the tendency to keep repeating my old mistakes.

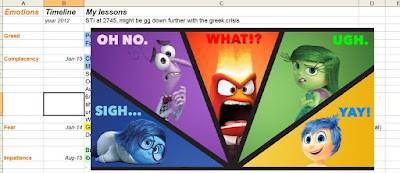

So I have created an Inside-Out table in an excel sheet format. (Yes, the boring excel sheet is a wonderful tool for all sorts of recording!) The table has got three columns which runs down chronologically. One column is the date, one is the emotions or 'how I was feeling at that point' and the third is a description of the mistakes made. 'How I am feeling' column is filled according to my emotion that triggered the mistake at that point when I made the decision.

I find this chart very useful in helping me to identify and keep track of which emotions hindered my investment decisions. This is an example of my "Inside-Out" table:

I am not saying here that all bad investment decision are triggered by bad emotions. Sometimes it could be a lack of due diligence, sometimes it could be just a plain unlucky incident (a fundamentally sound company suddenly got involved in some scandal).

The crucial point is - when we are swayed by emotions, we tend to make irrational investment decisions and we should learn not to let these emotions navigate us through the market.

Now try and make your own "Inside-Out" table /chart to look into your own investment emotions. You might just find a new world of old emotions and your own lessons.

Hopefully we will get to sprinkle our table with points of 'joy' and 'relief' as well to congratulate ourselves for good decisions made.

***

So I have created an Inside-Out table in an excel sheet format. (Yes, the boring excel sheet is a wonderful tool for all sorts of recording!) The table has got three columns which runs down chronologically. One column is the date, one is the emotions or 'how I was feeling at that point' and the third is a description of the mistakes made. 'How I am feeling' column is filled according to my emotion that triggered the mistake at that point when I made the decision.

I find this chart very useful in helping me to identify and keep track of which emotions hindered my investment decisions. This is an example of my "Inside-Out" table:

|

| Why so many 'oh no' and 'ugh's?! |

I am not saying here that all bad investment decision are triggered by bad emotions. Sometimes it could be a lack of due diligence, sometimes it could be just a plain unlucky incident (a fundamentally sound company suddenly got involved in some scandal).

Now try and make your own "Inside-Out" table /chart to look into your own investment emotions. You might just find a new world of old emotions and your own lessons.

Hopefully we will get to sprinkle our table with points of 'joy' and 'relief' as well to congratulate ourselves for good decisions made.

***

Comments

Post a Comment